Commercial property insurance is good to have for those who own a business or company. You can benefit from the many protective aspects that these policies offer. The property that you do business in is important and because of this, you have to make sure you’re choosing the right plan that covers and protects every aspect you can think of regarding your company’s space.

The repairs, replacements, and other maintenance tasks can be covered under this type of insurance if something like this was to happen. You can cover fires, vandalism, and even theft, if it occurs at your place of business.

Learn more about commercial property insurance and find out if this is something that you should be able to get for yourself and your business. It might just protect you against those issues that arise.

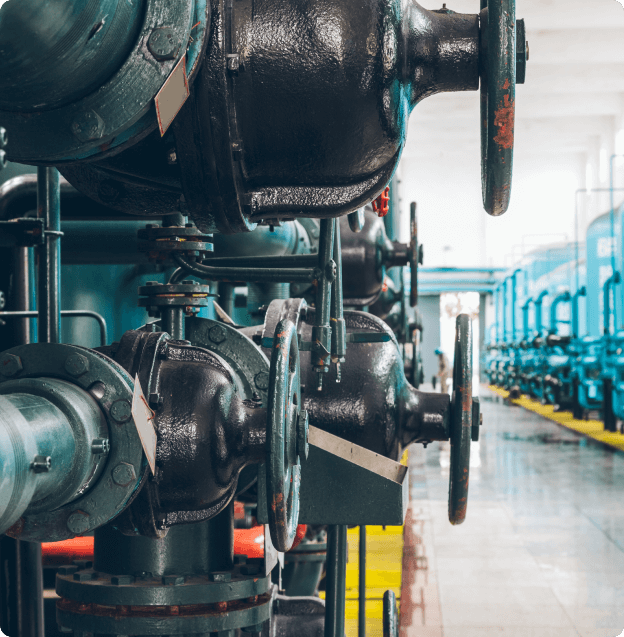

Commercial property insurance is able to cover a wide assortment of things. The property, equipment, supplies, and the other costs that come with the property and machines within are covered when the perils are something that is covered under the policy.

Anything can happen and when it comes to a business, you need to protect those within it and the structure it is built within. With a full comprehensive business owner’s policy, you can include this type of coverage, or you can choose to have this policy as a stand-alone type of coverage for your business.

You can grab the actual cash value of the cost it would take to rebuild the machines or the structures of the business or you can look into the replacement costs and the insurance company will pay the repair company to do so.

There is even a payment protection program that can help you keep your employees paid during those times when you might be having a tough time doing so. This is something that can help you keep everyone running, while also keeping your business up and running. Sometimes, this can be something that is useful, but it also gives you the peace of mind knowing that you can also pay for your mortgage costs, as well as any other protection that you require.

Find out what your business policy is able to cover when it comes to commercial property insurance for your business.

Even if you’re a business that is leasing the space, you want to make sure that you’re still able to get insurance. In some cases, the building owner requires those leasing from them to hold this type of insurance, especially liability insurance and coverage for the structure.

However, if the building’s owner already has the building insured and it is not an obligation from the business owner leasing from them, it is not mandatory. However, our insurance specialists do recommend getting some sort of coverage for the items within the building and even parts of the building where you work in case of accidents.

This is something you can speak with our qualified, professional agents regarding. Get the most from your business but protect all of your assets at the same time. PAIB can help!

The insurance coverage does not and will not cover all of the legal risks that your business may come across or have to deal with.

There are many clauses that should be considered when choosing a commercial property insurance plan. Depending on what you want to have covered and what you don’t, you should think about what exactly is going to be covered in the specific plan you choose.

For example: you may need additional coverage for windstorms, hail, floods, anything that is not attached to the structure or the ground, the land itself, plants, or any vehicles that might be housed there because they are business vehicles. These would need a different insurance policy to be covered.

When working with PAIB, you can let us know what you want to have covered and we’d do our best to protect any areas that you feel need to be protected most. Speaking with us can give us an idea of what exactly it is that you are looking for in commercial property insurance.

The costs can vary, as with any other insurance policy. Depending on a few factors, you might pay more or less. However, in general, the costs of commercial property insurance is minimal compared to other types of costs if something were to happen.

We can go over all of the options with you to come up with the best one that fits the needs you have.

We offer the best quotes out there that are given for free and are highly customized to the needs that you have. This can be worth it to look into if you want to learn more about what to expect for the different insurance coverages there are, and which might be the most ideal for your specific commercial property and the insurance coverage you’d like.

Speak with us today and we’d be more than happy to offer the best insurance policy for your business or commercial building, or even a full, comprehensive insurance plan that offers the many coverage types that you need.

Call Us Today!

Call Us Today!  Send A Message

Send A Message Office Address

Office Address101 Pine Street South Timmins ON, P4N 2K1